Description

In operation, an authorized person can record the data of all employees on a driver-related basis, evaluate them on the basis of the vehicle, archive them and settle them to the nearest kilometer.

Writing a logbook by hand is history with the electronic logbook MTrack®

Many companies have field staff who are very rarely in the company and around two-thirds of all companies in Austria are sole proprietors who have a particularly high demand for efficient time management.

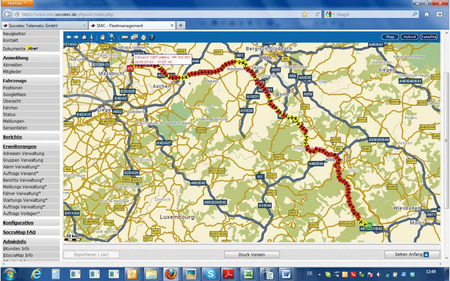

With logbook MTrack® you have Internet-based software at your disposal that replaces the manual with the electronic logbook

MTrack® was developed from our own hand and therefore short response times to your inquiries are possible and the self-explanatory operation minimizes the training time. The server is located in Austria and you get an individual, personal and quick help for your questions.

With the electronic MTZ logbook you save 95% on time, 80% on administration costs and 8% on costs – and all this from a single vehicle. Calculate your savings with our savings calculator! Our electronic logbook was developed according to the Austrian guidelines of the tax office and of course also recognized.

Requirements for the logbook according to the tax office

The more accurate the records, the more believable the logbook! – Because not only date, place, time and mileage at the beginning and end of the professional journey are a must in the logbook, but also the duration and purpose of this trip, as well as the kilometers driven, which must be documented separately after professional and private trips.

A logbook of the program MS Excel is no longer correct, because it has the possibility to change the data in retrospect and the subsequent changes are no longer traceable.

According to the tax office, every subsequent change to the logbook must be documented and the completeness and correctness of the documentation must be guaranteed. In addition, the material accuracy must be able to be checked with reasonable effort, the guide of the logbook done in a closed form and the possibility of subsequent manipulation be excluded.

True to the motto MEASURE = KNOWLEDGE = IMPROVE, you are guaranteed to be on the safe side with the electronic MTZ logbook.

Click here to learn more!

Comments are closed here.